(5-minute read)

Let’s start with a simple explanation and definition of SSI.

Self-sovereign ID is a type of digital identity. It gives individuals full digital control of their identities and their private personal information.

SSI reduces or eliminates unintended or unwanted disclosure of the ID owner’s personal information. This is in contrast to the traditional identity system in which the individual’s personal information is controlled by an external credential issuer.

A good way to think of SSI is to consider how it establishes trust in an online interaction. The credential holder presents the SSI credentials to another party. The receiving party verifies that the credentials were issued by a trusted source. Now, the receiver’s trust in the credential’s issuer transfers the trust back to the credential holder. The credential holder is authenticated.

Section Menu:

- Self-sovereign ID became possible when blockchain technology was developed

- Identity the way it used to be

- How does identity confirmation work when you can’t show a physical ID?

- Digital identity: the solution to online authentication

- The siloed model

- The federated model

- The best model: SSI

- The demand for digital identity will only get stronger

Self-Sovereign ID Became Possible When Blockchain Technology Was Developed

Or, to put it another way, blockchain played a foundational role in the development of a completely new way for us to protect, manage, and share our personal information. The detailed technology explanation is beyond the scope of this content. If you’re interested to learn more, abundant information is available online.

Identity The Way It Used To Be

It’s always been important for us to be able to identify ourselves. We used our driver’s license, our birth certificate, our Social Security number, our property deeds, our tax records, and a dozen other types of identification to establish our authenticity.

Our forms of ID were trusted because they were issued by trusted entities, such as governments and other high-profile private organizations. This identity method flourished because everyone used the same forms of ID. Fast forward to today.

How Does Identity Confirmation Work When You Can’t Show A Physical ID?

It’s always been important for us to be able to identify ourselves. We used our driver’s license, our birth certificate, our Social Security number, our property deeds, our tax records, and a dozen other types of identification to establish our authenticity.

Our forms of ID were trusted because they were issued by trusted entities, such as governments and other high-profile private organizations. This identity method flourished because everyone used the same forms of ID. Fast forward to today.

Digital Identity: The Solution To Online Authentication

That’s pretty obvious. Digital identity is already used widely today for online access to more than just financial services. It’s also a factor in healthcare, retail, restaurants, and more. Right now, most of it involves usernames, passwords, challenge questions, multi-factor authentication, or some combination thereof.

Digital identity is available in three forms, only one of which offers genuine unique benefits to both CU members and credit unions themselves.

The Siloed Model

When the member opens an online account, username, password and other private personal information is stored in a large data silo (database.) The organization owns the member information, not the member.

The Federated Model

This is the process by which the responsibility for personal user authentication is delegated to an external partner. The external partner, the identity providers (IDP) owns the member data, not the member.

The Best Model: SSI

All things considered, the third type, SSI, is the most privacy-preserving digital identity model. It’s the best fit for all types of financial services, especially credit unions and members. And, the members own their own data!

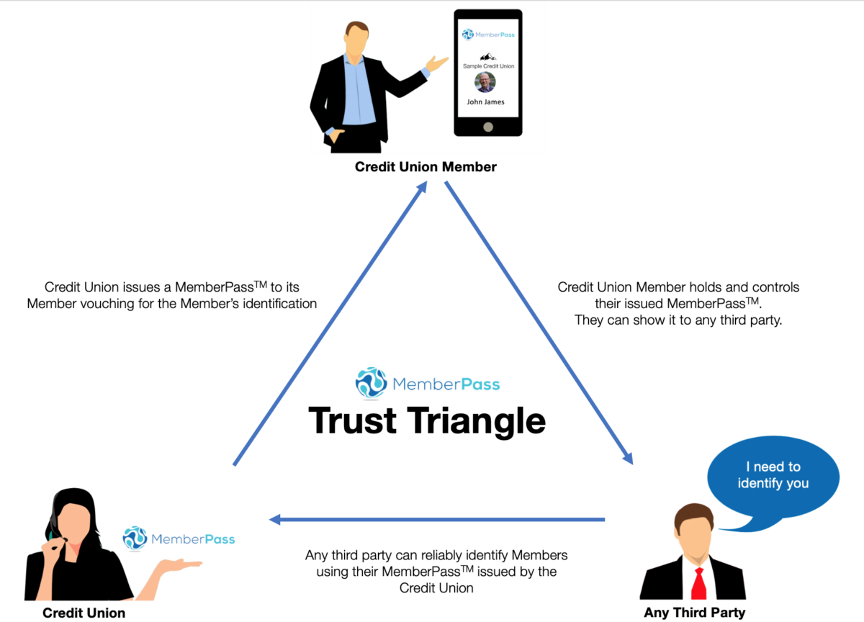

It’s helpful to think of MemberPass, the credit union SSI, as a “trust triangle.” It works like this:

A self-sovereign identity allows members to retain full control of their personal information. It adds security and flexibility because it allows them to reveal only the data necessary for a given transaction. Best of all, it’s almost impossible to hack or steal.

It effectively gives members a direct, encrypted digital connection to the credit union. No third party comes between you and your member. And no one but the member owns his or her personal data!

The Demand For Digital Identity Will Only Get Stronger

If you don’t already have a good digital ID solution at your credit union, we suggest you learn more about MemberPass.

Your members will thank you when they see the direct and immediate benefits of MemberPass digital ID. It’s fast, secure, virtually unhackable, and immune to identity theft. Plus, each member owns and controls their personal information.

To request a MemberPass demo, email us to set one up. You can also register to attend a webinar or simply visit us online at www.memberpass.com to find out more.

The sooner you get started, the sooner your members can enjoy the benefits!

Bonifii, a credit union service organization, offers MemberPass, a simple, secure and convenient member identity verification method. MemberPass is a digital passport that provides members convenient access to their financial accounts while allowing control and privacy over their personal information. We leverage touchless technology to protect you and your members. Visit www.memberpass.com or email sales@memberpass.com.